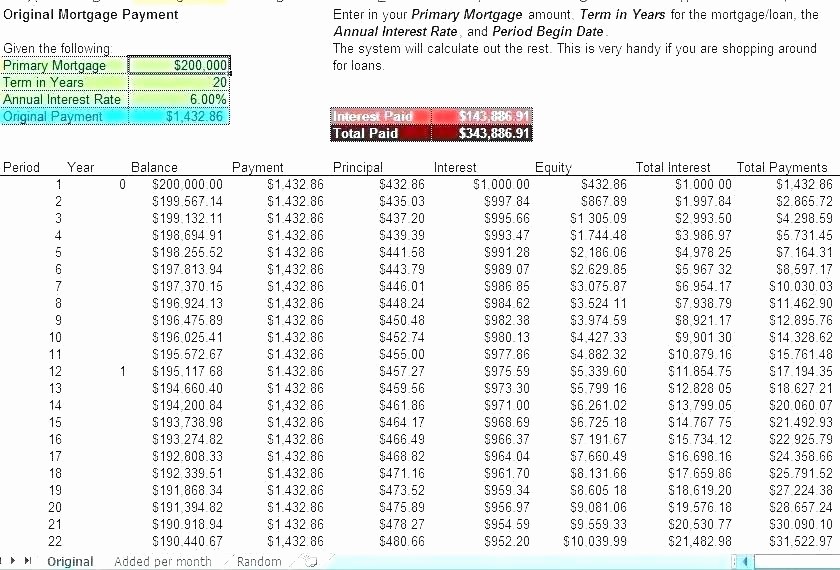

Bendigo Express available via online application only. For the Bendigo Complete Loan the variable interest rates displayed are based on Loan to Value Ratio (LVR) calculated using your LVR at the date we document your loan contract. The rates and repayment amounts do not include any monthly service fees or lenders mortgage insurance if applicable. Interest rates are subject to change except during a fixed rate period. The results assume regular scheduled payments and that the interest rate does not change, and do not include any discount period. There are restrictions and/or certain fees payable for additional payments for some products e.g. We have the Annual Interest Rate of 5, and an annual rate that begins with an annual percentage rate.

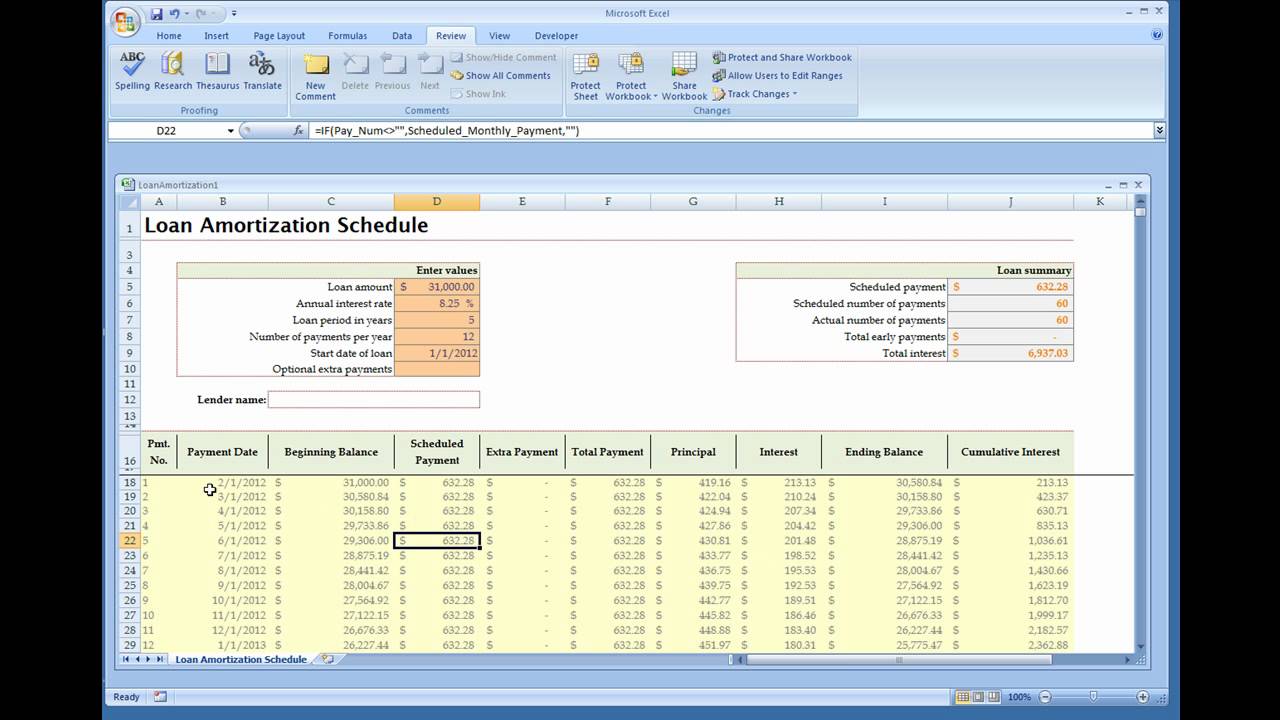

To create an amortization schedule that includes an extra payment. If you need to plug in more information such as the PMI, tax insurance, or any other data, please use the mortgage calculator with PMI. To proceed, we have to establish the input cells first. The simple loan calculator with amortization estimates the monthly payment based on the mortgage amount, loan terms, interest rate, and the starting payment date. The offset account is not available for all loan products. Step-By-Step Procedures to Make an Amortization Schedule with Extra Payments in Excel Step 1: Specified Input Fields. You should speak to us or obtain professional advice about a loan that meets your requirements and objectives.

The results are not advice on how much you can or should borrow, which product you should choose, the product features or options, or about making extra payments. They are not a quote, credit approval or offer of credit.

0 kommentar(er)

0 kommentar(er)